May 31, 2019 –

Guest Blog Author: Tom Hawkins, Retirement Clearinghouse

As May ends and we observe the close of Older Americans Month, a time to recognize the role that older adults play in society and their many contributions. This year for the first time, the U.N. released figures showing the world has more older people than younger children -confirming the arrival of a long widening global trend.

For younger working women, Older Americans month offers a rare reminder and planning opportunity to consider how certain life defining decisions will determine how they will pay for their increasing longevity. Today by age 85+, two-thirds of the elderly are women, and many are living alone.

It’s an ideal time for younger women to consider if their future as “older Americans” is financially secure or may be filled with regret. Unfortunately, regret will likely haunt millions of younger women who prematurely cash out their 401(k) savings. Not only are these women potentially sacrificing their retirement security, but research also reveals they’ll regret these decisions more than men, and that regret will continue to grow over their longer lifespans.

Each year, 5.9 million American women enrolled in 401(k) plans will change jobs. 2.4 million, or 41%, will cash out completely. For younger women, the outcomes are worse. According to the Employee Benefit Retirement Institute (EBRI), women ages 25-34 will change jobs every 2.7 years, and for women with 401(k) balances less than $5,000, cash out rates soar to 71%.

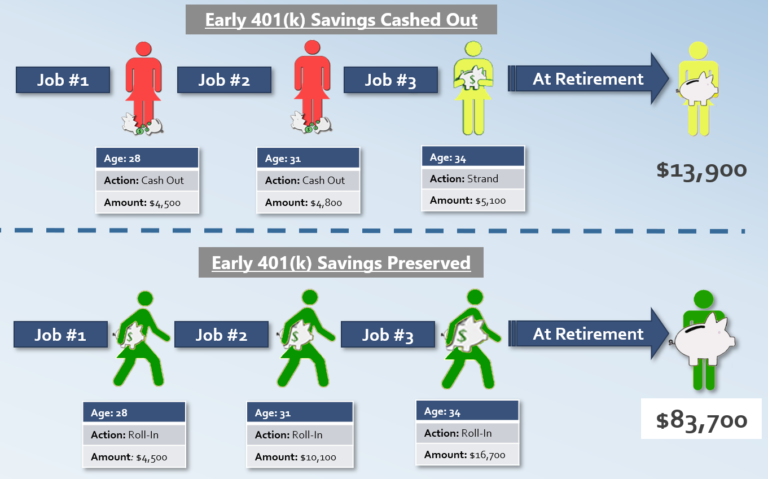

For example, a typical 25-year old woman could change jobs three times prior to age 34 and cash out two of her first three 401(k) balances. At 34, she would preserve only $5,100 in retirement savings, which will yield just $13,900 in savings by age 67. In contrast, had she avoided cashing out, she would have $83,700 at retirement.

Figure 1: Illustration of the Effects of Cashing Out, Women Ages 25-34

Source: Retirement Clearinghouse / EBRI Webinar (EBriefing: Trends in Employee Tenure, 4/10/19)

In 2015, a survey by Boston Research Technologies revealed that cash out regret is real and increases over time. 36% of Millennials who’d cashed out already regretted their decisions, rising to 46% for Gen-Xers, and to 53% for Baby Boomers. The survey also found that women experience much higher levels of cash out regret than men, particularly among Millennials, where 46% of women regretted cashing out, vs. 30% of men.

Cashing out a 401(k) balance is one that women should avoid unless you’re facing a true financial emergency. Consolidating your retirement savings as you move from job-to-job, will not only preserve your savings, but will simplify your retirement planning, reduce fees and motivate you to save even more. Finally, auto portability, is a new plan feature designed to automatically move small-balance retirement savings forward, and should help 401(k) participants changing jobs.

Preserving retirement savings in your 20’s and 30’s will put you on the way to a secure, and comfortable retirement, and ensure that you don’t have to live with those regrets.